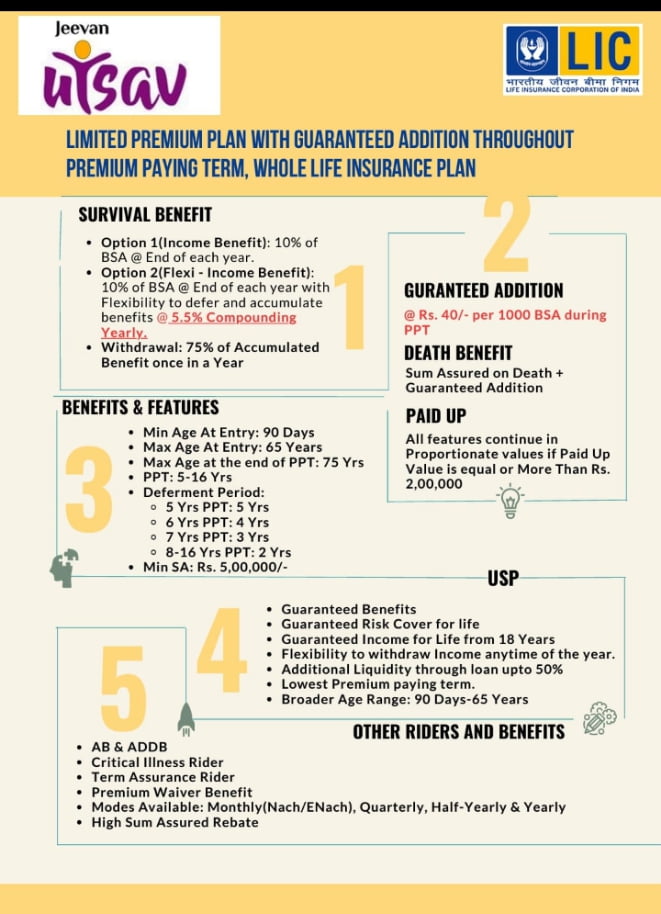

According to some Media quoting Sources, and some reliable sources it is come to my knowledge that, LIC ( Life insurance corporation of India) Going to launch a New plan / policy / scheme. Named ” JEEVAN UTSAV” ( PLAN NUMBER 871 ) Whole Life Guaranteed Income plan. It is LIC PLAN.

Coming to my knowledge from some people in my native place and nearest places in India says that, Previously LIC has launched So many policies (plans) they are mostly long term policies , They are looking for short term and Life long regular income benefits POLICY with life insurance cover, Covering to these features LIC has stepped one more step towards this, LIC is added some more features In ” JEEVAN UTSAV” Plan they are as follows :

LIC NEW PLAN / LIC NEW POLICY 2023. Which Policy Fits for Today’s Market Demand. It is None other Than ” JEEVAN UTSAV”. New LIC POLICY / PLAN.

I. (1). After Deferment period, Survival Benefit of , Guaranteed, 10 % of Sum Assured, Tax Free Return for LIFE LONG. (For Example S.A. 20,00,000 X 10 % that is 2,00,000 Yearly Life Long) ( This is option one) OR. Accumulating the Regular income @ 5.5 % Interest and it is compounding for next years. For Withdrawal at will. ( Withdrawal Facility once in a policy year, A maximum of 75 % of Balance, ( From Accumulated Flexi income Benefits including Interest ) ( This is option Two ) : CHOOSE ANY ONE OPTION..

(2). Guaranteed yearly addition of Rs. 40 per thousand Basic Sum Assured. For Premium paying Term (PPT)

(3). LIC Plans for 5 Years. and also Suitable Lic Plans for 15 Years. Proposer can choose 5 year Premium payment Term (PPT) , OR 5 to 16 Years. ( According to proposers need) and Deferment period is also there it is given below.

(4). For Childs Policy After Completing 18 years , 10% of SA Benefits Starts.

This is the best Lic plans for kids / Lic plans for child future / Lic plans for girl child as well as, lic policy for girl child, and as good as boy child also. best lic policy 2023.

II. Policy Conditions: (1) Entry Age 90 Days to 65 Years

(2) Minimum Sum Assured 5 Lakhs and Maximum Sum Assured No Limit ( According to their Conditions)

(3) Loan and Surrenders: After 2 years Premium paid and year completed.

III. Premium paying term and Deferment period.( Depend on PPT)

PPT 5 Years——– 5 Years, that is total 10 years , Guaranteed income starts at 11 th year.& onwards.

6 Years ——- 4 years,

7 Years ——- 3 Years, and

PPT 8 Years To 16 Years —— 2 Years After PPT Guaranteed Income Starts.

Note : For Childs After 18 Years Completed G Income Starts.

IV. Optional Riders Available For an some Little Extra Premium. :

(1) Accidental Death Benefit Rider OR Accidental Death & Disability Benefit Rider.

(2) New Term Assurance Benefit Rider.

(3) Critical Illness Benefit Rider

(4) Premium Waiver Benefit Rider

lic policy plan / plans , are for peoples need based. Childs future protection and education purpose suitable. lic plans for Womens.

For an Example 1 ) : A Person Aged 32 Years, Just Pay for 5 Years (PPT) and Wait for 6 Years ( Deferment Period) He took For 5,00,000 Sum Assured Policy and the Premium is (nearly) Rs. 1,14,571. ( + tax extra) At the Age of 43 Years he Starts to Get 10 % of Sum Assured Guaranteed Benefit that is Rs. 50,000 Yearly For Life long. Suppose if he Survives up to 80 Years of his Age Means ( 80 minus 43 = 37 years he get Guarantee Benefit that is Rs 50,000 X 43 = Rs. 21,50,000. After,

His DEATH Nominee will Get Total of Rs 6,00,000. (That is Basic Sum Assured 5 Lakhs + 5 Years PPT Guaranteed Addition RS. 1 Lakh ( Amount of Rs 40 per 1000 SA per Year That is Rs. 20,000 per year for 5 Years ) )

If A persons Death occurs before PPT Say 2 Years after policy taken he paid 2 years premium then the Nominee will get Rs. 5,40,000. (That is Sum Assured+2 Years Guaranteed Addition = 5 Lakhs + Rs 40,000 )

Example 2) : B person Takes A policy on His Childs name ( child’s life) With Premier Waiver Benefit Rider. Suppose here the Childs Age is 4 Years, Sum Assured 20 Lakhs, Premium Paying Term 12 Years, Then The Yearly Premium is Rs. 1,80,000. (Nearly) At the 18 th Age of Child Gets Survival Benefit of 10 % of Sum Assured = 2,00,000 yearly Life Long (Guaranteed),

If he Survives up to 81 Years of his age = 63 Years X 2 Lakhs Yearly = Totally He gets Rs. 1,26,00,000.

After his Death Nominee will gets Sum Assured + Guaranteed Addition for 12 Years = Rs. 20 Lakhs + Rs. 9,60,000 = Totally Rs. 29,60,000.

In Case Death of B person in Premium Paying Term Further Premiums Are Waived But, His Child Gets All Above Said Benefits.

In case of Childs Death Before The Commencement of Life Risk The Nominee will gets Only The Returns of paid Premiums.

In Case of Childs Death After the Commencement of Life Risk, The Nominee will gets Sum Assured +G.A = 20 Lakhs + G.A.